If you’re an existing homeowner who purchased your property as recently as 2022, you probably have a really low, fixed mortgage rate. Perhaps something that starts with a 2, 3, or 4.

After all, mortgage rates hit record lows in 2021 and were generally very cheap for about a decade.

In spring of 2022, that changed and rates began surging higher as inflation took hold and the Fed ended its MBS-buying program known as Quantitative Easing (QE).

While 30-year fixed mortgage rates are no longer a screaming bargain, they’re not far from their long-term average of about 7.75%.

But because everything else is so expensive, the mortgage itself actually eats up a smaller share of total housing costs.

Housing Costs Go Far Beyond a Simple Mortgage

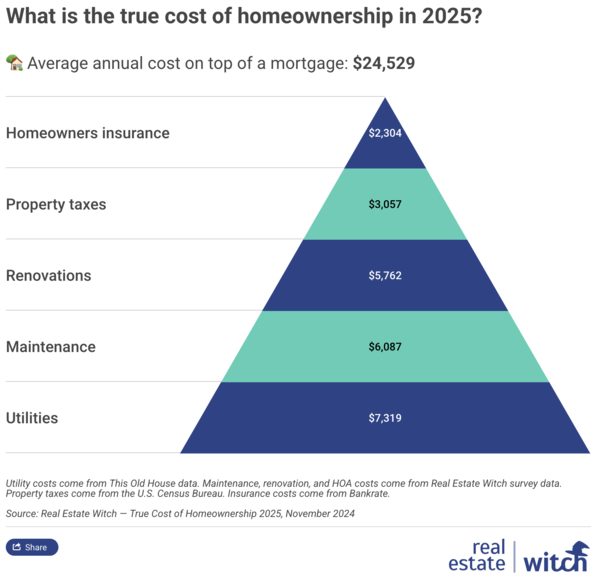

A new survey from Real Estate Witch found that non-mortgage costs have increased to $24,529 for 2025, up from $17,958 in 2024.

This includes homeowners insurance, property taxes, home renovations, routine maintenance, and monthly utilities.

Broken down it looks like this:

Utilities: $7,319

Maintenance: $6,087

Renovations: $5,762

Property taxes: $3,057

Homeowners insurance: $2,304

Depending on where you live, some of these costs might seem low or high, but it’s the average cost taken from various websites utilized for the survey.

And chances are homeowners insurance will only be going up next year, pretty much no matter where you live.

Meanwhile, the typical household spends $26,508 annually on the mortgage, which isn’t much more than these other costs combined.

In other words, the mortgage now only makes up about half of the total annual housing expense.

If we include folks who live in homeowners associations, the non-mortgage total rises to $27,606 annually, which is above the typical mortgage expense.

This is something to consider if you’re weighing a rent vs. buy decision and focusing solely on mortgage rates and home prices.

Be sure to consider all the other costs, both expected and unexpected, when you make this determination.

The survey also revealed that roughly 8 in 10 homeowners (81%) said the “true cost of owning a home” was higher than they anticipated.

Meanwhile, almost half (44%) said they felt it’s easier to be a renter than a homeowner.

We’re All Paying for Those Record Low Mortgage Rates Indirectly

Lately, the mortgage has become one of the cheapest components of homeownership, while all the other costs have become more expensive.

This is pretty unique, and it is likely because of those record low mortgage rates, which ironically might be to blame for the subsequent inflation we’ve experienced lately.

You see, all those years of easy money and low interest rates had a price. And that price is inflation, with the dollar eroding in value as the cost of just about everything has risen tremendously.

However, the lucky homeowners who were able to lock in a 30-year fixed at 2-4% have an incredible inflation hedge.

But you could argue that they’re paying for it another way now, via rising costs elsewhere.

And it’s even worse for those who have yet to enter the housing market, who are facing the worst affordability in decades.

Renters are dealing with higher costs across the board due to all that inflation, which can partially be blamed on the zero interest rate policy (ZIRP) put in place post-2008 and again during the pandemic.

However, they’re receiving none of the benefit, unlike homeowners.

Meanwhile, there are the home buyers who had to settle for a mortgage rate in the 6-8% range over the past couple years because of said inflation.

Everything has a price, and ultimately this creates an even bigger divide between the haves and have nots.

Once You’re Free and Clear You Still Won’t Be Truly Free as a Homeowner

This brings up another important point. Say you pay off your mortgage in full. A lot of people have been big on paying off the mortgage early lately.

While I don’t agree with it, assuming you have a super low fixed rate (which I see as good debt), it doesn’t mean you’re without payments.

As illustrated above, you’re still on the hook for property taxes, homeowners insurance, maintenance, utilities, and renovations if necessary.

And that can amount to a lot of money, even if you no longer have a mortgage.

So one has to question if free and clear actually lives up to its name. Sure, it’s one less bill, but it doesn’t mean you’re living for free!

Long story short, if you’re thinking of buying a home, be sure to use a good mortgage calculator that factors in ALL the monthly costs.

And don’t underestimate anything. If anything, overestimate to leave room in case these costs continue to rise. They likely will!

Otherwise, you might be like the nearly 1 in 4 millennial homeowners (23%) who said the costs of homeownership have made them want to go back to renting.

The survey, conducted between November 27th and 30th, 2024, asked 1,000 American homeowners about their homeownership-related expenses and their experiences dealing with those costs.

(photo: atramos)