Less than a week after a task force was launched to “eliminate waste, fraud, and abuse” at HUD, it appears nearly half of the Federal Housing Administration (FHA) is set to be laid off.

The shock development was reported by Bloomberg, based on “two sources” who are familiar with the plan.

Just last Thursday, HUD Secretary Scott Turner unveiled plans to trim down the agency, claiming to identify over $260 million in savings, with more to come.

And like other government departments recently affected by layoffs, DOGE appears to be moving very quickly and aggressively at HUD as well.

The big question is how the layoffs might affect the agency, and if they will be clawed back if disruptions occur.

FHA Layoffs Are the Latest Shock to the System

In just under a month, there have been countless government layoffs across many departments, including the Department of Energy, the Department of Education, the EPA, IRS, CDC, and many others.

Another 75,000 government employees have accepted voluntary buyouts as well as the Department of Government Efficiency (DOGE) seeks to cut spending.

It appears no section of the government is being spared, and the latest cuts have rattled the agencies that play a major role in the housing market.

While it’s unclear how many employees will be affected, the parent of the FHA, the U.S. Department of Housing and Urban Development, or HUD for short, employs about 9,600 employees, per its own website.

Last week, DOGE said half of the HUD workforce was being eliminated. But at the time, FHA employees weren’t affected by the news.

It appears things have changed and now nearly half of the FHA is being eliminated as well.

Within HUD there are many departments, including the FHA and Ginnie Mae, the latter which provides guarantees on mortgage-backed securities (MBS) issued by the FHA, VA, and USDA.

FHA Loans Play a Huge Role in the Mortgage Market

After conforming loans backed by Fannie Mae and Freddie Mac, FHA loans are the most common type of mortgage available to home buyers today.

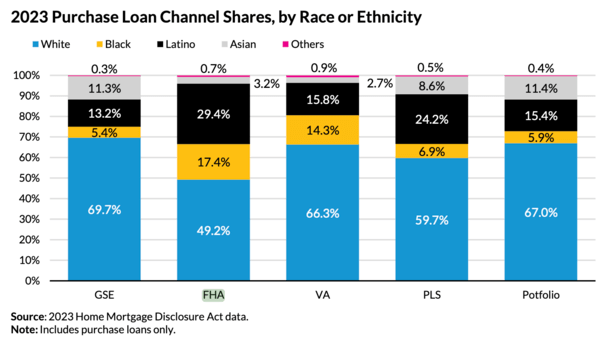

And they are especially important for minority home buyers, including Black and Latino borrowers, per the Urban Institute.

So to say this is a very big deal would be a huge understatement. The one silver lining, if you could even call it that, is that loan volume has been very low lately compared to recent years.

This means disruptions might be less of an issue as the staff that remains will have fewer loans to process than in recent years.

After all, with mortgage rates now closer to 7% than 3%, far fewer borrowers are refinancing their mortgages.

And home purchases are also down significantly, with only about four million home sales last year amid deteriorating affordability.

But if delinquencies become a bigger issue in coming years, there could be increased pressure on the FHA, especially if it’s short-staffed.

Can I Still Get an FHA Loan?

The short answer is yes, you can. While the layoffs appear to be sizable, I doubt DOGE would do anything to jeopardize your ability to get an FHA loan.

As noted, they are very common types of mortgages that used by millions to purchase a home, thanks in part to their low 3.5% down payment and liberal credit score requirements.

While the FHA is a government agency, FHA loans are issued by individual banks and mortgage lenders.

Much of the process is carried out by private sector employees like loan officers and mortgage brokers who aren’t employed by the government.

In other words, the federal government doesn’t issue FHA loans, it simply sets the underwriting guidelines and insures them once they fund.

Ideally, this means you should continue to be able to apply for an FHA loan and close the loan without issue.

If you’re currently in the process of obtaining an FHA loan, the same basic rationale applies. Your loan will more than likely continue to move forward as expected.

However, given the severity of these layoffs, it’s not a bad idea to anticipate longer processing timelines and to plan accordingly.

This could affect a mortgage rate lock if the funding takes longer than expected or if there are any other unexpected snags.

Be sure to communicate with your loan officer or mortgage broker to get updates on the FHA’s system status.

Read on: FHA vs. conventional loans.