With home prices out of reach for many today, an obvious question has been when will the housing market crash?

To be honest, this question gets asked pretty much every year, and it is a certain cohort of the population that always seems to want it to happen.

I get it – homeownership should be within reach for everyone in this country, but lately prices and elevated mortgage rates have made it a bridge too far for many.

Despite this, I do believe it will get better as time goes on, thanks to moderating home price gains (even some losses) along with more attractive mortgage rates.

Maybe even wages will catch up while we’re at it. But a housing crash? Probably not with the current mortgage stock.

Today’s Mortgages Just Aren’t the Early 2000s Ones

As such as some folks want to believe that today’s mortgages are just like the ones we saw in the early 2000s, they simply aren’t.

And I’m actually sick and tired of people trying to make that argument. I was there. I originated loans in 2004, 2005, 2006, 2007, etc.

I saw the toxic loans that were getting approved on a daily basis, which eventually led to the worst mortgage crisis in modern history.

It’s just not that way today, despite the widespread availability of stated income and even no-doc mortgage products.

First off, those loans are now niche, offered by so-called non-QM lenders that aren’t the default (no pun intended) option for home buyers today.

The ATR/QM rule made it much more difficult for lenders to offer loans with limited documentation or exotic features like negative amortization or 40-year loan terms.

So while this stuff is available, it’s just not as common, and represents a fraction of the overall lending universe.

In 2004-2007, your typical mortgage was stated or no doc and it had zero down payment. Different days.

It Continues to Be an LTV Story in the Mortgage World

Of course, life happens, and with it comes mortgage delinquencies. Those have been on the rise lately, with FHA loans one area of concern.

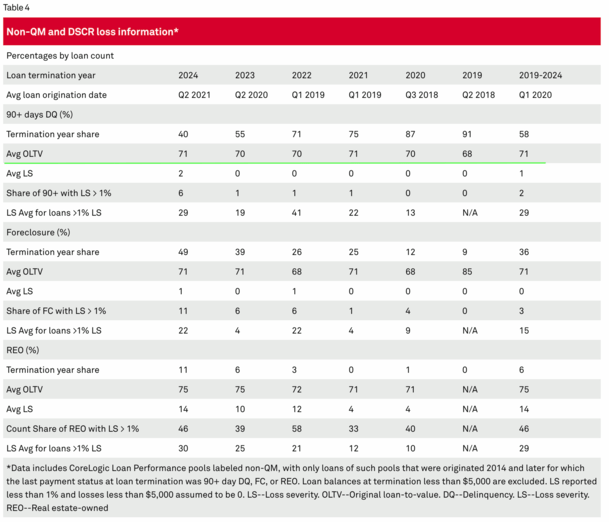

There are also non-QM loans and DSCR loans, which have seen mortgage lates increase in recent years.

Despite this, the housing market is holding up really well today. But why? Shouldn’t prices crash if people can’t make their payments or afford to take out new mortgages?

The answer is actually pretty simple: LTVs. Low ones. Unlike in the early 2000s when you could get a no-doc loan at 100% LTV/CLTV.

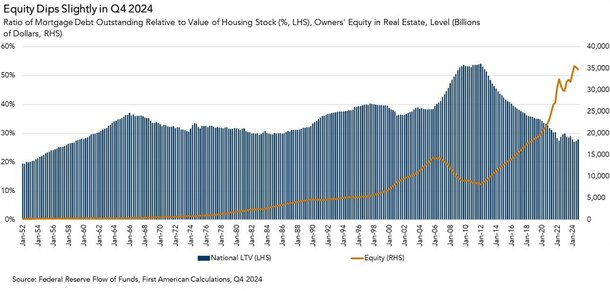

The national loan-to-value ratio (LTV) is very low today, at around 28% at last glance, per First American. In 2008, it was hovering near 55%.

You can thank larger down payments, lower maximum LTV limits, and surging home prices, which have led to record high home equity.

Oh, and homeowners aren’t even touching that home equity in most cases, with HELOCs and home equity loans still untapped by most.

And those risky no-doc and stated income loans that resurged in recent years? Well, most lenders require massive down payments, such as 30% down or more.

This explains why aren’t we seeing foreclosures and short sales despite rising delinquencies on DSCR and non-QM loans that require no income documentation.

Distressed Home Sellers Can Sell without a Loss

Today, these distressed borrowers are able to “sell the property, extract equity, and satisfy the loan obligation,” per a new analysis from S&P credit analysts.

In 2008, if you fell behind on the mortgage, you often had zero equity because you put nothing down, which meant either a short sale or foreclosure were the only options.

Clearly this wreaked havoc on home prices and led to one of the worst downturns in history.

The good news is because of that event, mortgage underwriting guidelines improved tremendously.

If you want something outside the norm of Fannie, Freddie, the FHA, or a VA loan, you’ll need a lot of skin in the game.

It helps to have 30% equity or down payment when you get a mortgage. Because if you have a loss of income or insufficient cash flow to service the mortgage payment, you can sell the property without taking a loss.

This is good for lenders and the borrowers, and the housing market overall. It buffers home prices.

Speaking of, the “housing stock nationally continues to be supply constrained (due in large part to mortgagors’ reluctance to sell homes and give up historically low fixed rates), which has been a factor in preventing price declines at the national level.”

So the majority of the outstanding homeowner universe is unwilling to sell because their mortgage rate is fixed at 2-4%.

This further buffers the housing market and keeps supply tight, limiting downside to home prices. And as noted, we have much lower LTV maximums than we had in the early 2000s.

That wasn’t the case in the early 2000s, when you could get a no-doc investment property mortgage with zero down!

Obviously having zero skin in the game made it very easy for the property to become a short sale or foreclosure once the borrower couldn’t make payments. Not so anymore.

Taken together, yes, it is actually different today. But if lenders were handing out stated income and no doc loans at 100% LTV again, I’d join the doomer camp immediately.

Fortunately, you still need a massive down payment to get a stated/no-doc DSCR loan or non-QM loan.

If/when that changes, I’ll worry.

Read on: Will the housing market crash in 2025?