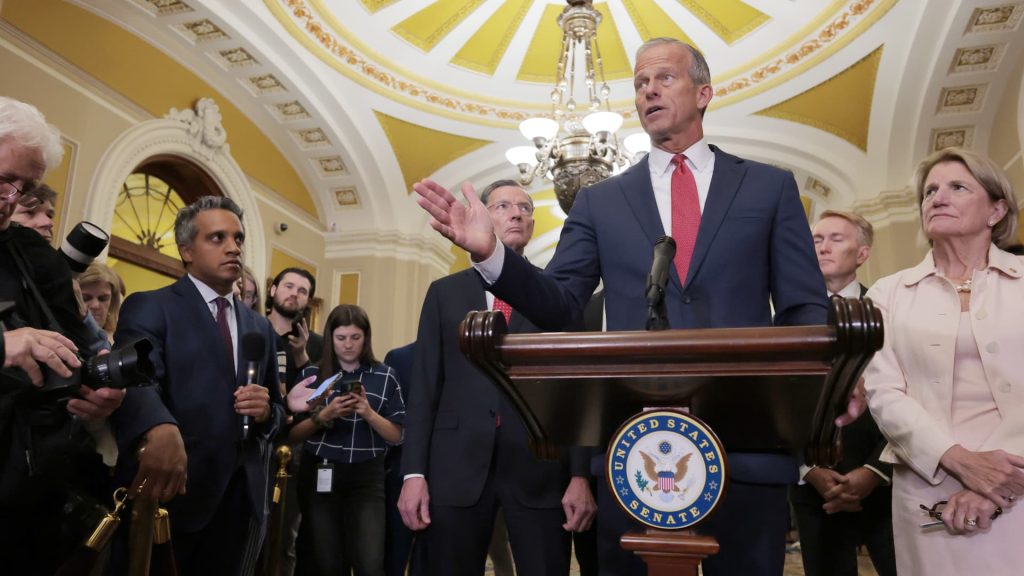

Senate Majority Leader John Thune (R-SD) speaks during a news conference following the weekly Senate Republican policy luncheon at the U.S. Capitol on June 17, 2025 in Washington.

Anna Moneymaker | Getty Images News | Getty Images

Senate Republicans on Tuesday passed changes to the federal deduction for state and local taxes, known as SALT, as part of President Donald Trump’s multitrillion-dollar spending bill.

Passed via the Tax Cuts and Jobs Act, or TCJA, of 2017, there’s a $10,000 limit on the SALT deduction through 2025, which has been a pain point for certain lawmakers in high-tax blue states.

If enacted, the Senate bill would lift the cap to $40,000 starting in 2025, with the phaseout starting over $500,000 of income. Both figures would increase by 1% yearly through 2029 and the $40,000 limit would revert to $10,000 in 2030.

More from Personal Finance:

What the Senate Republican tax and spending bill means for your money

‘Revenge saving’ picks up as consumers brace for economic uncertainty

How the GOP budget bill targets immigrant finances

By contrast, the House-approved measure under the One Big Beautiful Bill Act would offer the higher limit for a longer window. The $40,000 cap would begin in 2025, with the same $500,000 income phaseout, and both figures would rise by 1% annually from 2026 through 2033.

The Senate’s legislation still needs House approval before the final bill can be delivered to Trump’s desk. It was unclear Tuesday whether moderate House Republicans would accept the Senate’s proposed SALT deduction changes.

Before TCJA, the SALT deduction was unlimited for taxpayers who itemized deductions. But the so-called alternative minimum tax reduced the benefit for some higher earners.

While the higher SALT cap lasts longer under the House bill, SALT relief is two-thirds larger in the Senate bill when including alternative minimum tax changes, according to a Saturday analysis from the Committee for a Responsible Federal Budget.

Both bills also reduce itemized deductions for certain taxpayers in the 37% income tax bracket, which could lower the benefit of the higher SALT cap. This reduction is bigger in the House bill.

How the SALT deduction works

When filing taxes, you pick the greater of the standard deduction or your itemized deductions, including SALT capped at $10,000, medical expenses above 7.5% of your adjusted gross income, charitable gifts and others.

Starting in 2018, the Tax Cuts and Jobs Act doubled the standard deduction, and it adjusts for inflation yearly. For 2025, the standard deduction is $15,000 for single filers and $30,000 for married couples filing jointly. These could increase under the Senate-proposed tax bill.

Under the current thresholds, the vast majority of filers — roughly 90%, according to the latest IRS data — use the standard deduction and don’t benefit from itemized tax breaks.

Who benefits from the higher SALT cap

Raising the SALT deduction cap would primarily benefit higher earners, according to a May analysis from the Tax Foundation.

The Senate legislation would also protect a SALT cap workaround for pass-through businesses, which allows owners to sidestep the $10,000 cap. By contrast, the House-approved bill would have ended the strategy for certain white-collar professionals.

This SALT “deal” in the latest Senate bill is a nonsensical approach to tax policy.

Chye-Ching Huang

Executive director of the Tax Law Center at New York University Law

“This SALT ‘deal’ in the latest Senate bill is a nonsensical approach to tax policy,” Chye-Ching Huang, executive director of the Tax Law Center at New York University School of Law, wrote in a post on X on Saturday.

“It preserves (and lessens) a limit on deductions for wealthy taxpayers while ignoring a loophole that allows the wealthiest of those taxpayers to avoid the limit entirely,” she wrote.