I have an important rule for my dividend stocks: no dividend cutters.

There are several reasons.

1. A management team that cuts the dividend is likely to do it again.

By reducing the dividend, management has proven that the dividend is not sacred. There are companies that have raised their dividends every year for decades – and others that have never cut the dividend. Those management teams will do everything in their power to ensure that the dividend is not lowered.

A company that has never lowered the dividend (or, even better, raises the dividend every year) projects confidence and sets a high bar for performance.

With track records of solid dividend payments for 10, 20, 30 years or more, these companies would have a lot of explaining to do if the payout to shareholders were suddenly reduced. It would signal that something is very wrong at the company.

Once a company has made the agonizing choice to cut the dividend, each time it does so again becomes a little less painful and a little easier to do.

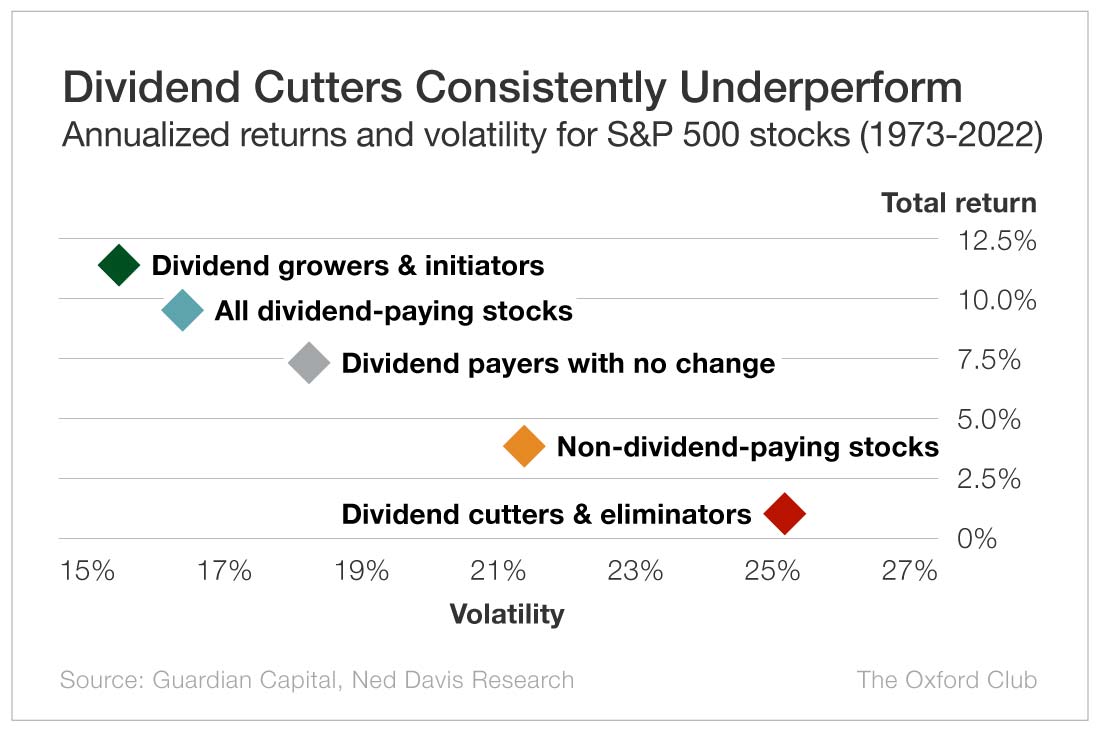

2. Dividend cutters’ stock performance is awful.

Companies that lower their dividends tend to underperform the S&P 500 by a whopping 15 percentage points over the five years following the cut.

They even underperform non-dividend payers. They have the worst performance and highest volatility by a mile.

3. No one wants a pay cut.

The income that retirees generate from their investments is often an important part of their financial health. If their dividends are being cut or they’re worried about a reduction in income, that can cause a lot of stress and even a change in lifestyle.

While no dividend is guaranteed, companies with outstanding long-term track records of dividend stability and growth can make it easier for you to sleep at night since you’re not as worried about your income.

Dividend cutters have poor performance and higher risk, they reduce the amount of money in your pocket, and they are likely to continue down that slippery slope.

There is almost never a good reason to add a dividend cutter to your portfolio.